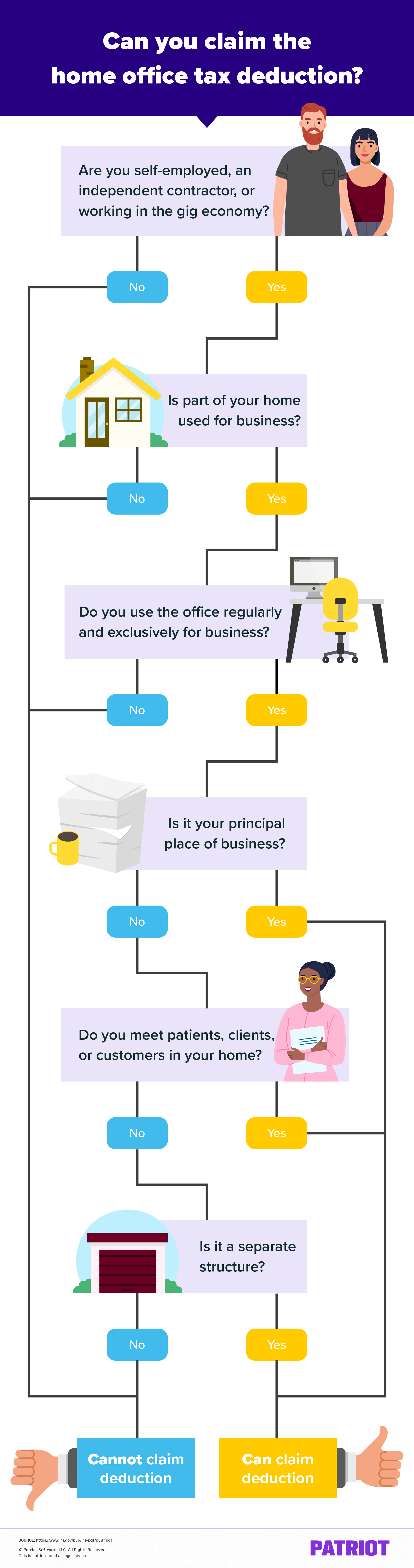

Home Office Tax Deduction Desk . Web home office deduction at a glance. Web what is the home office deduction? You can take the simplified or the standard option for calculating the. Equipment, furniture, and shelving, all of which cost you a pretty penny. Web your home office may appear to be full of tax deductions at first glance: You’re most likely eager to deduct every dime if you qualify for as a home office. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. If you use part of your home exclusively and regularly for conducting.

from www.patriotsoftware.com

Web what is the home office deduction? Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. If you use part of your home exclusively and regularly for conducting. You can take the simplified or the standard option for calculating the. Web home office deduction at a glance. You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at first glance: Equipment, furniture, and shelving, all of which cost you a pretty penny.

Home Office Tax Deduction Deduction for Working from Home

Home Office Tax Deduction Desk You’re most likely eager to deduct every dime if you qualify for as a home office. Equipment, furniture, and shelving, all of which cost you a pretty penny. You’re most likely eager to deduct every dime if you qualify for as a home office. You can take the simplified or the standard option for calculating the. Web home office deduction at a glance. Web your home office may appear to be full of tax deductions at first glance: If you use part of your home exclusively and regularly for conducting. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. Web what is the home office deduction?

From jasciante.blogspot.com

How To Calculate Home Office Tax Deduction OFFICE Home Office Tax Deduction Desk Web your home office may appear to be full of tax deductions at first glance: If you use part of your home exclusively and regularly for conducting. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. Web home office deduction at a glance. Equipment, furniture, and shelving, all of. Home Office Tax Deduction Desk.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Home Office Tax Deduction Desk Web home office deduction at a glance. Web what is the home office deduction? You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at first glance: Equipment, furniture, and shelving, all of which cost you a pretty penny. If you use. Home Office Tax Deduction Desk.

From hardgeconnections.com

Home Office Tax Deduction How Does It Work? Hardge Connection Home Office Tax Deduction Desk Equipment, furniture, and shelving, all of which cost you a pretty penny. You can take the simplified or the standard option for calculating the. Web what is the home office deduction? Web your home office may appear to be full of tax deductions at first glance: You’re most likely eager to deduct every dime if you qualify for as a. Home Office Tax Deduction Desk.

From www.stkittsvilla.com

Is Taking A Home Office Deduction Smart American Portfolio Blog Home Office Tax Deduction Desk Equipment, furniture, and shelving, all of which cost you a pretty penny. Web home office deduction at a glance. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. You’re most likely eager to deduct every dime if you qualify for as a home office. You can take the simplified. Home Office Tax Deduction Desk.

From pooleyacctg.com

Home Office Deductions 101 Pooley Accounting Services Home Office Tax Deduction Desk You can take the simplified or the standard option for calculating the. Web what is the home office deduction? Equipment, furniture, and shelving, all of which cost you a pretty penny. If you use part of your home exclusively and regularly for conducting. You’re most likely eager to deduct every dime if you qualify for as a home office. Web. Home Office Tax Deduction Desk.

From www.stkittsvilla.com

Home Office Tax Deductions Checklist Do S And Don Ts Home Office Tax Deduction Desk Web what is the home office deduction? You can take the simplified or the standard option for calculating the. Web home office deduction at a glance. Equipment, furniture, and shelving, all of which cost you a pretty penny. You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear. Home Office Tax Deduction Desk.

From turbotax.intuit.com

The Home Office Deduction TurboTax Tax Tips & Videos Home Office Tax Deduction Desk If you use part of your home exclusively and regularly for conducting. You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at first glance: Web to qualify for the home office deduction, you must use part of your home regularly and. Home Office Tax Deduction Desk.

From www.autonomous.ai

Maximize Savings Home Office Tax Deduction 2024 Tips Home Office Tax Deduction Desk If you use part of your home exclusively and regularly for conducting. You’re most likely eager to deduct every dime if you qualify for as a home office. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. Equipment, furniture, and shelving, all of which cost you a pretty penny.. Home Office Tax Deduction Desk.

From www.etsy.com

CPA Prepared Home Office Deduction Worksheet Etsy Home Office Tax Deduction Desk If you use part of your home exclusively and regularly for conducting. Equipment, furniture, and shelving, all of which cost you a pretty penny. Web home office deduction at a glance. You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at. Home Office Tax Deduction Desk.

From justpaste.it

How to maximize your home office deduction as a selfemployed Home Office Tax Deduction Desk Web your home office may appear to be full of tax deductions at first glance: You’re most likely eager to deduct every dime if you qualify for as a home office. Web home office deduction at a glance. Web what is the home office deduction? Equipment, furniture, and shelving, all of which cost you a pretty penny. If you use. Home Office Tax Deduction Desk.

From advisorsavvy.com

Advisorsavvy SelfEmployed Home Office Tax Deduction in Canada Home Office Tax Deduction Desk You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at first glance: If you use part of your home exclusively and regularly for conducting. Web to qualify for the home office deduction, you must use part of your home regularly and. Home Office Tax Deduction Desk.

From www.dontmesswithtaxes.com

Home office tax deduction still available, just not for COVIDdisplaced Home Office Tax Deduction Desk Web home office deduction at a glance. You’re most likely eager to deduct every dime if you qualify for as a home office. Equipment, furniture, and shelving, all of which cost you a pretty penny. If you use part of your home exclusively and regularly for conducting. Web what is the home office deduction? You can take the simplified or. Home Office Tax Deduction Desk.

From www.smallbusinesssarah.com

How to Get a Home Office Tax Deduction Small Business Sarah Home Office Tax Deduction Desk If you use part of your home exclusively and regularly for conducting. Web home office deduction at a glance. You’re most likely eager to deduct every dime if you qualify for as a home office. Web what is the home office deduction? Web to qualify for the home office deduction, you must use part of your home regularly and exclusively. Home Office Tax Deduction Desk.

From barszgowie.com

Home Office Tax Deduction A Comprehensive Guide Home Office Tax Deduction Desk Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. Web what is the home office deduction? You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at first glance: You can. Home Office Tax Deduction Desk.

From quickbooks.intuit.com

The complete home office tax deduction guide QuickBooks Home Office Tax Deduction Desk Web home office deduction at a glance. You’re most likely eager to deduct every dime if you qualify for as a home office. Web your home office may appear to be full of tax deductions at first glance: Web what is the home office deduction? You can take the simplified or the standard option for calculating the. Web to qualify. Home Office Tax Deduction Desk.

From prospecttax.com

Home Office Tax Deductions What You Need to Know Home Office Tax Deduction Desk Equipment, furniture, and shelving, all of which cost you a pretty penny. Web home office deduction at a glance. You can take the simplified or the standard option for calculating the. If you use part of your home exclusively and regularly for conducting. Web your home office may appear to be full of tax deductions at first glance: You’re most. Home Office Tax Deduction Desk.

From www.lessaccounting.com

Home Office Tax Deduction Explained Home Office Tax Deduction Desk Web home office deduction at a glance. Equipment, furniture, and shelving, all of which cost you a pretty penny. If you use part of your home exclusively and regularly for conducting. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. You can take the simplified or the standard option. Home Office Tax Deduction Desk.

From www.rklcpa.com

I work remotely during COVID19. Can I take a home office tax deduction Home Office Tax Deduction Desk Web your home office may appear to be full of tax deductions at first glance: Equipment, furniture, and shelving, all of which cost you a pretty penny. Web to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. You can take the simplified or the standard option for calculating the. You’re. Home Office Tax Deduction Desk.